This is a counseling session usually spanning 30-45 mins with a SEBI Registered Investment Advisor and would include

Consulting Fees: 5,000/-

Our recommended process of Financial Planning includes

...and thereby helping you to invest your money in such a way as to take you as close as possible towards achieving your dreams by making suitable periodic course corrections.

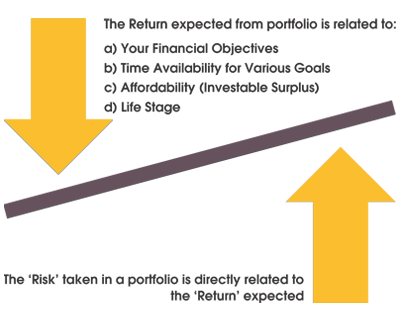

The general perspective is that the returns are proportional to the risk undertaken. As the popular saying goes, "No risk, No gain" or "Higher the risk higher the possibility of returns. Though this appears to be correct, it is incomplete. The question is, where do i cap my expectation of returns?

Most people do not have an answer to this. In Horus we anchor the expectation around 4 parameters:

Based on these parameters, we first derive the returns that should be generated through investments and in turn create the investment portfolio with appropriate asset allocation. This approach gives us a more practical methodology to decide on what risk profile a person SHOULD have rather than what risk profile he WANTS to have.

This program is an exotic trip into the world of finance for kids of age group 7 to 14 years, this workshop consists of 8 sessions of 2 hrs each. The sessions would be filled with stories, videos, role plays and activities enabling the children to understand these concepts in a very simple and entertaining manner. This program teaches the kids the basics of money right from its origin to the technology used today for it.

This is an educative and interactive session with complete focus on understanding the behavioral patterns of people when it comes to their decisions with money. The session would deal with in detail the following points:

This service would be absolutely free of cost and is purely with an intention of creating awareness about the need for professional financial planning across all levels of employees.

This is a one on one counseling session usually spanning 45mins to 1hr and gives a quick analysis of one's current financial health and suggestions on immediate remedies. This is done mainly in large organizations enabling us to reach out to maximum people from various strata of society with high efficiency and is concurrent with our mission statement.

This educational capsule equips the participant with a "Do It Yourself" tool kit to help him get started with his own financial planning.

This is an awareness seminar on the various pit falls that an investor faces in the mostly jargonistic financial jungle. This gives the investor the right perspective of various financial tools available in the market. The main contents of this session would be as follows:

This is an awareness seminar which puts light on various financial matters of individuals/families and help them to develop a right attitude towards money. The main contents of the session would be as follows:

companies

employees

sessions

Everyone knows that having a plan is better than not having one. But we all wait for the perfect day on which we will get around to doing it and somehow the perfect day never arrives.

Here's your chance to create a quick outline of your financial goals and also check it's feasibility using our unique Open Portfolio Philosophy and Calendar based approach! In the end you will also get a detailed set of investment recommendations from a SEBI Registered Investment Advisor. It's an ideal blend of 'Doing It Yourself' along with expert advice and support where you need it the most, on demand!

And that too for a fee of just Rs. 15,000/- for a year. Try it today!